Often times a company entering into a fundraise for the first time has no idea what to put into a dataroom. Having worked in venture capital myself for a long time, very often first time founders struggle to provide requested documents promptly.

Preparation for a fundraise starts the moment a company is set up. Investors literally expect to see Certificates of Incorporations as part of their due diligence, but also many of the more mundane requests, such as accounts, contracts, and agreements, are items you should keep in good order from time to time. When they are asked, you will not have time to look for them nor prepare them - momentum is key in any transaction. You should always manage the business as if to exit tomorrow (even if you're not intending) so best to keep the house in good order.

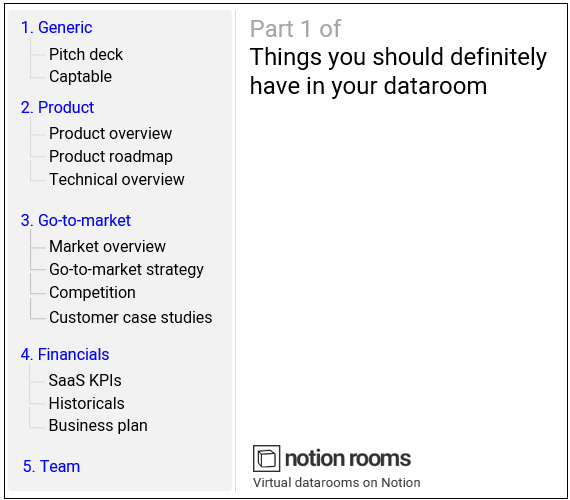

In this brief blog series we will focus helping you build a typical dataroom. We will start by building the preliminary dataroom, sometimes also called “phase 1 dataroom”, or the dataroom that has the essential fundraise documents. This is the place where you direct your investors after they come to you and say “Your company looks interesting. I would love to dig in a bit more to see if there is a case to be made”.

With that, below are some of the most commonly seen items you should have in your this Phase 1 dataroom. Let's have a quick look at them one by one:

Organizational

Pitch Deck - Sometimes just called ‘the deck’. It is important as it gets passed around the team and conveys your story without you having to be present. It is of course also a quick summary of your all areas of your business in an easily digestible format.

Captable - Rather self-explanatory. Investors want to know who owns what and how much.

Product

Product Overview - Sometimes this is simply a few minute video presented by the founder where you go through the typical use case showcasing your product's key features. Occasionally you may also see another longer version with extended features but it’s less common as investors typically have a separate in-depth product demo.

Technical Overview - While the above is more focused on the commercial use cases, this is more focused on how the product is actually built. Technical documentation includes architectural diagrams, cloud infrastructure, stack used, and more. You should at least have this in back pocket once asked.

Product Roadmap - Certainly include something on the roadmap. This helps investors to know what is around the corner and understand your longer term vision. It can be just a simple process chart, but it is a very important document.

Go-to-market:

Market Overview - Includes some off-the-shelf market studies (e.g. from Gartner or Forrester) to help investors get up to speed quickly on your specific market. If you're feeling fancy, you may include your own market sizing estimates as well.

Go-to-market - After you’ve told investors how enormous your market is, you will want to explain to them how you’re going to capture it. This document is typically (at this stage) a brief slide deck showcasing your sales and marketing strategy in depth.

Competitive Differentiator / Benchmarks - Not always present, (and we debated whether to include this or not), but frankly helping the investors position your company against competitors is helpful. For example, if you have any specific benchmarks include them here.

Customer Case Studies - Finally proudly flaunt your success stories if you have any. Investors love logos and customer case studies help them build a picture of why customers decided to opt for your product.

Financials

SaaS KPIs / Customer Cube - If you are a software company with a subscription model chances are your investors will want to see your (redacted) customer cube to evaluate your business by cohort. This is typically presented as a simple matrix with customers as rows and monthly payments as columns.

Historical Numbers - These are your (unaudited) historical Income Statement, Balance Sheet and occasionally Cash Flow Statement as well. Have it for the past few years and opt for nicely formatted management accounts.

Financial Plan - Sometimes combined with above historicals, financial plan is a more detailed excel model giving the investors idea of how you will use the proceeds and where those proceeds will get you.

Team

Team is always important, but at this stage the documentation around it does not need to be anything too scientific. Nowadays a lot of this information can be found on public records such as Linkedin, Glassdoor, and public articles. CVs and more detailed background checks will likely need to be provided in the phase 2 of the deal.

That’s it in brief. You might wonder where are all the legal documents and contracts - well first of all, at this stage that might be a bit too sensitive to share as you'll likely share this Phase 1 dataroom with hundreds of investors. Yet at this stage many still gauging whether they even like your business and you risk handing out too sensitive information. Second of all, well, the investors can always ask if they need that.

In any case, this should honestly get you 95% there. In fact, we've made this easy for you - you can simply copy the template from the official Notion template databank: https://www.notion.so/templates/simplest-fundraising-dataroom

There will of course always be ad-hoc requests and quirky asks and don't let those catch you off guard! Just roll with the punches. You may want to create a list of all ad-hoc questions so you have the answers when they will (inevitably) be asked again. Good thing is, Notion is very suitable for all of the above. And once that's set up, make sure to plug it into Notion Rooms.

Notion Rooms is on open beta and bugs will occur. Send bugs and feedback to oskar (at) notionrooms.com

Copyright Notion Rooms 2024 | Privacy Policy | Terms of Service